Under the IICA flagship project on Competitiveness and Sustainability of Agricultural Chains for Food Security and Economic Development it was identified, that a major problem, for all 10 participating countries and agro-food chains, is the limited access to and the low penetration of financing into agro value chains.

By Dr. Joaquín Arias, Policy and Sectoral Analysis Specialist, IICA, joaquin.arias@iica.int

Under the IICA flagship project on Competitiveness and Sustainability of Agricultural Chains for Food Security and Economic Development(1) it was identified that one of the major problems in the ten participating countries is the limited access to and the low penetration of financing instruments in the agro value chains.

In response to this problem, IICA is working in seven countries(2) on identifying constraints, opportunities, scalable best practices, and innovations in policy instruments to improve financing for agro value chains. The final product will be a proposal with recommendations for public-private interventions to improve financing and financial inclusion in agricultural chains in Latin America and the Caribbean (LAC). We hope to generate, with the participation of an ample number of stakeholders, valuable technical inputs to improve financing in agricultural chains throughout the region.

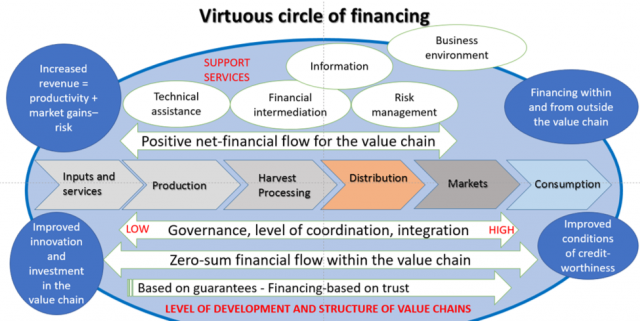

The motivation behind this effort is to trigger a process to move from a vicious to a virtuous cycle of financing within the value chain and from outside sources (see diagram). As a starting point, the importance of the value chain approach to strengthen ties and proximity of players to the market must be recognized, for there to be a rapid and timely flow of information. This is especially important for the changes in consumer preferences and attributes, in order to develop stronger linkages among stakeholders in every stage from producers to consumers, to increase value added, and to promote greater inclusion, translated into the active participation of stakeholders in the process and benefits of development of the value chain. A distinction should be made between actors and service providers, the former being those that at some point own the products offered or that flow along the value chain, and the latter as service providers, whether public or private, such as finance, information, technical assistance, etc.

It is recognized that value chains are characterized by different structures and levels of governance, organization, coordination and integration between chain links. Better governance (development of relations based on rules and trust, mechanisms of accountability, common vision, etc.) and greater coordination and integration will set the stage for larger flows of financing within the chain, in the form of credit by the seller or merchant, deferred payments, advances, self-insurance, among others. With the development and modernization of the value chain, financing normally moves from relying on guarantees (mortgages, for example) to a system based on relations and trust. In any case, this flow of funding within the value chain, while desirable, is a zero-sum game, because there is no capital inflow or new investments coming from outside the chain.

Therefore, for the development of value chains and the agro-food sector, financial intermediation is essential as a support service to the chain (financial intermediation establishes the encounter between savings, credit and investment in the economy). Financial intermediation is what allows a positive net-flow of capital for the value chain, which complements the internal flow of capital between chain links. Recognize that for financial intermediation to be effective and efficient it must be accompanied by other services or interventions such as information, risk management practices and technical assistance. In addition, the environment in which value chains function is a crucial determinant for financing. This is because the macro environment (economic and non-economic) significantly influences business expectations, the perception of risk, and is a critical factor that affects sales, consumption, inflation, interest rates and liquidity in the financial market.

In this context of development and modernization of the value chain, the challenge is to trigger a virtuous cycle of financing, with positive externalities, starting with making actors creditworthy, or by improving their eligibility for credit. This will increase funding internally and from outside the value chain, which is a critical factor to increase revenue based on productivity improvements, market gains and risk reduction. These in turn become incentives for innovation and investment in the chain, improving further creditworthiness among players, and so on. It is not difficult to imagine how the concepts within this circle in the diagram contribute to improving the status of individual producers’ and other actors’ creditworthiness. Nor is it difficult to imagine a scenario where it predominates the vicious circle, which must be broken, of lack of funding that impede the development of the value chain, and the opposite, that absence or slow development of the value chain impede or slow funding.

IICA is currently in the process of reviewing studies carried out in seven Latin American countries to characterize the supply and demand of financial services of a chosen agro chain and their macroeconomic and sectoral context; at the same time, conducting workshops at the country level with a wide range of participants representing the given agro value chain IICA is organizing a workshop in Washington DC (likely to be held in November of this year) as an opportunity to validate the results and make additional recommendations with the contribution of IICA’s institutional partners that work in the same topic of financing for agriculture in the Americas and in other regions. Please stay tuned for further developments.

1:See for further information about the project

2:Vegetables-Argentina, flowers-Paraguay, beef-Uruguay, coffee-Peru, cocoa-Colombia, cocoa-Costa Rica, fruits-El Salvador

*The terms of reference that are available online (http://goo.gl/bRWgBu –Spanish only).

*The opinion expressed in this newsletter are those of the author and they do not reflect the position of the Institute on the topics presented.

* This post appears in the IICA Delegation in the USA Newsletter – July – August 2016